Here's the setup:

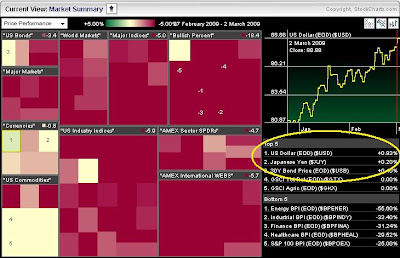

Here's the setup:1) There's an established downtrend or sell signal (or uptrend if you're buying) on the higher time frame...in this case the higher time frame used was the daily chart, and the sell signal for the daily chart was the same as the signal for the hourly...a macd and stoch combination,

2) The MACD signal line has begun declining and is about to cross the moving average,

3) The stochastic is oversold and is moving lower.

Once I saw all of these conditions in place, I placed the trade and set a stop just above the upper Bollinger Band and I set a profit target for 70 pips based on the lows from earlier in the day. This trade ended up being a textbook trade because it played out perfectly...have to enjoy it because that doesn't happen that often.

So how did I come up with this trade? I found it by doing my daily scan through the charts this morning. I like to look over all of the daily, hourly, and 5 minute charts for all of the major currency pairs and a few of the popular crosses every morning. Going through the motion of looking through these various charts in different time frames helps me stay in tune with the market and it often generates a few trading ideas as well. This is a practice that I highly recommend and it's easy to do. Just spend 10-15 minutes and look over charts at roughly the same time every day and make note of any potential setups, patterns or trades.

Good luck out there.

TLT