The Eur/Usd rallied pretty hard today following this morning's economic releases. What is significant about today's rally? Well, the pair managed to substantially break the trend channel that the pair has been stuck in since the beginning of the year. Is this a big deal? Who knows. The best trades of the year for me have come from fading each break from the trend channel. Will today's rally be another good opportunity? I have no clue, but I did put the trade on. Here's the chart:

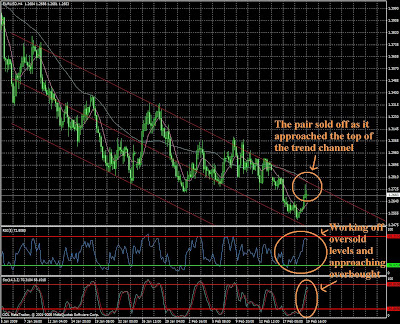

Notice that all of the prior breaks have provided great shorting opportunities. What I don't like about this one is that the break was more substantial than prior ones. So if I don't like it, then why did I put on the trade? Well, my TLT Trender System is still giving the Eur/Usd a sell on the daily level and one setup I like to trade is to fade channel breaks that occur on the 4 hour chart that break out against the direction of the trend (as determined by my TLT Trender) on the daily chart. Thus, if the daily chart says sell, I fade bullish trend channel breaks on the 4 hour time frame. Here's the daily chart for the pair:

My main concern with this trade is that I may get stopped out Sunday evening if a continuation rally occurs when Japan's market opens up. In forex, the Sunday night or Monday morning (depending on which side of the globe you're on) continuation rally is quite common. In fact, it can be a good trading setup in and of itself. Just find a pair that is really moving in one direction right up to the close Friday afternoon and put on a position in the same direction with a 30-50 pip profit target. Unfortunately, this continuation can be dangerous if you're fading Friday afternoon's price action (like I am). For this reason, I think I'll widen my stop a little and wait for the pair to open and settle down on Sunday/Monday.

Have a good weekend.

TLT