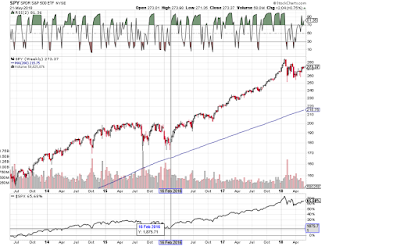

Glancing at some charts today, the market is showing some short term bull signals. The bump in volatility early this year looked more like the beginning of a regime shift than a normal pullback but only time will tell. We've had quite the run in the indexes over the last few years and the market looks like it will give another push to new highs. Here's a weekly of the SPY:

You can see the dramatic shift in price action starting in late January of this year. Highs and lows are more extreme on each candle and the back and forth is very quick compared to the drawn out dips and slower climbs of the past 4 years.

Here's a very bullish chart. This is a pair chart of the Consumer Discretionary (XLY) over the Consumer Staples (XLP). If the chart goes up it is generally bullish because discretionary is outperforming the staples.

Of course, all of this is subject to change in about 5 seconds with something new hitting the market. This just tells me that more money is still being placed in discretionary(bullish) rather than staples(bearish). All things staying about the same, the market will likely try to push back up to the highs.

As for the long term, I still think we will be seeing some major volatility and a bear market coming out. Real estate prices across the country are in a bubble on almost all levels and some signs of a slow down are already showing. For all of the talk of lack of inventory, the real demand for housing for the lowest priced newer homes and those are the homes that builders have not been building. Why build a $250k home to make $35-45k in profit when you can build a $750k home and make $100k in profit? I expect this to be the last strong year in residential real estate and then for commercial to start slowing down too.

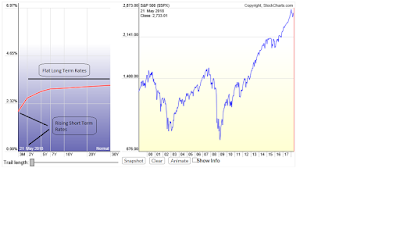

Still the most bearish yellow/red flag is the yield curve. Short term rates have gone up, which we new would happen and the FED has been pretty open about it. The problem is in the longer term rates that are flat. This is the beginning steps for an inverted yield curve.

With the real estate market looking fragile and developers continuing to finance new development projects with 1-2 year interest only bridge loans (happening a lot!), the stage is set for people to get burned and then the real wave of panic will hit the market. I'm not a big doom and gloomer but I like to be realistic. Being realistic also means respecting the market action that is currently occurring and not trying to push your views on the market. Just because I see the storms on the horizon doesn't mean I'm out shorting the market now..it just means I'm being defensive with longer term plays and gathering cash so that I'm ready for when things to get crazy.

Have a good week!

George

TLT

You can see the dramatic shift in price action starting in late January of this year. Highs and lows are more extreme on each candle and the back and forth is very quick compared to the drawn out dips and slower climbs of the past 4 years.

Here's a very bullish chart. This is a pair chart of the Consumer Discretionary (XLY) over the Consumer Staples (XLP). If the chart goes up it is generally bullish because discretionary is outperforming the staples.

Of course, all of this is subject to change in about 5 seconds with something new hitting the market. This just tells me that more money is still being placed in discretionary(bullish) rather than staples(bearish). All things staying about the same, the market will likely try to push back up to the highs.

As for the long term, I still think we will be seeing some major volatility and a bear market coming out. Real estate prices across the country are in a bubble on almost all levels and some signs of a slow down are already showing. For all of the talk of lack of inventory, the real demand for housing for the lowest priced newer homes and those are the homes that builders have not been building. Why build a $250k home to make $35-45k in profit when you can build a $750k home and make $100k in profit? I expect this to be the last strong year in residential real estate and then for commercial to start slowing down too.

Still the most bearish yellow/red flag is the yield curve. Short term rates have gone up, which we new would happen and the FED has been pretty open about it. The problem is in the longer term rates that are flat. This is the beginning steps for an inverted yield curve.

Have a good week!

George

TLT

No comments:

Post a Comment