I'll share some of my thoughts on the chart. I certainly would not go long because the 50ma slope is turning downward, which is very bearish. Furthermore, the 10ema is below the 50 ma and it just crossed the 200ma providing a nice signal to look for a shorting opportunity. Now here is the full chart. The vertical blue line is approximately where the first chart stopped. As you can see, this is a weekly chart of the SPY and it shows the 2000-2003 slide after the dot.com burst. Definitely don't want to be long. I really like using the different moving averages on the weekly charts because they can at least keep you on the right side of the long-term trend.

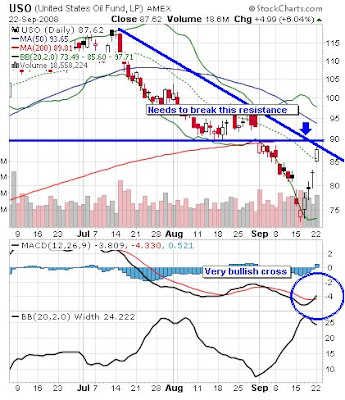

One more chart that provides some food for thought.

See any similarities between the above chart and the first one? Downward sloping 50ma...10ema crossing the 50ma and then the 200ma. Yikes! The current market is setting up sell signals in the broad indexes that we have not seen since the 2000-2001 time period. I think the path of least resistance is to the downside for now.