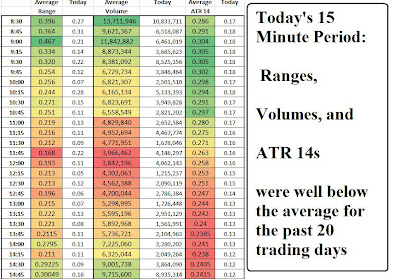

I keep an excel spread sheet that I update daily. This spread sheet tracks the average for the prior 20 trading day's average volume, range and 14 period ATR (average true range) for each 15 minute period of the trading day on the S&P 500 index etf (SPY). Okay, that was a mouthful. This spreadsheet is useful because I can look at it and tell what the average volume for the prior 20 days on SPY between 10:00 and 10:15. For example, today's volume for that period was roughly 2.5 million shares. By itself that doesn't mean much to some people. Well, my spread sheet tells me that the average for that 15 minute period (10:00-10:15) for the past 20 trading days is 6.8 million. It doesn't take a market wizard to figure out that today's volume for that period was way below average.

I print this sheet out in the morning and leave blanks to hand write the SPY volumes for that trading day. This method works better than just a moving average on the volume below the chart because it compares apples to apples (or the same period of time to the same prior periods). Here's a screen shot of today's sheet:

Maybe we'll see a little more follow through tomorrow..this chop can really put a dent in the P&L if you're not careful. The chop got me a little but fortunately I was catch some of the CSCO move this afternoon to put me in the green for the day.

Maybe we'll see a little more follow through tomorrow..this chop can really put a dent in the P&L if you're not careful. The chop got me a little but fortunately I was catch some of the CSCO move this afternoon to put me in the green for the day.Hope you all had a good start to the trading week.

TLT

2 comments:

Very nicely done, as I'm also a novice trader and follower of Dr Brett's blog (where I found your article link), how did you build your MS-Excel file of historical data?

I export the data from eSignal and have the formulas already input into excel. I keep a running log of all the data that I update daily and since the formulas are already entered into excel, I just cut and paste the prior 20 days data from the running list into my sheet with the formulas. Pretty easy to do and very helpful.

Post a Comment